Organization: Hai Tong Securities

Rating: Outperform

Investment Highlights:

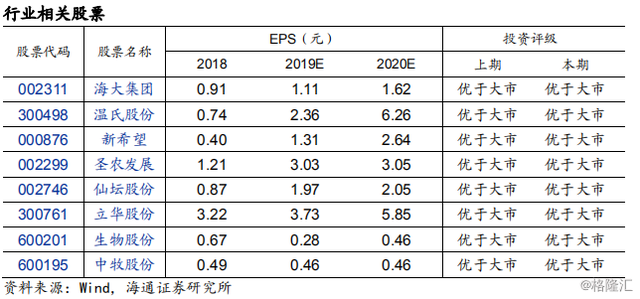

Pig farming: high degree of prosperity continues, adhere to the leading enterprises. Domestic African swine fever epidemic led to a substantial decline in industry capacity, safe and effective vaccines are still to launch, factors superimposed three yuan to stay sow productivity decline in hog supply returned to normal levels is still facing many difficulties and challenges, we expect the future of live pigs or shock will slow rebound; pork imports irreparable pork supply gap. We judge the first half of 2020 the average price of live pigs is expected to more than 30 yuan / kg, the year remained at a high bit Ge. Pig listed companies since the third quarter of this year to speed up the expansion pace in 2020 the majority of listed companies or the pig will usher in the amount of profits go up, rapid growth in market share; the recommended scale slaughter rapid growth of new hope and sound operation of Winchester shares.

Poultry farming: 2020 or will continue to achieve volume and price go . Live pigs continued downward since the outbreak of African swine fever, a shortage of pork in 2020, below the expected pig prices high, we believe chain poultry industry will significantly benefit from the demand for alternative upgrade. White chicken slaughterhouse focus on enterprise integration St. agricultural development, fairy altar shares, Huang Yu Li-hua chicken underlying shares.

Feed : feed sales in the category of marginal for the better, in the long run enhance concentration. In the long run, under the background of African swine fever epidemic feed industry reshuffle, industry concentration is expected to accelerate the upgrade, with a full range of competitive advantage or feed companies will come to the fore. In the short term, sales are expected to feed each category marginal to the good: 1) pig feed: pig herds stabilize superimposed pig prices high, sales are expected to bottoming out. 2) poultry feed: poultry chain high degree of market sentiment is expected to continue, sales continue to maintain a high growth rate. 3) aquatic feed: fish prices are expected warming, driven by sales recovery. The leading feed companies have continued to recommend a full range of competitive advantages large group.

Animal vaccines : Zhumiao near the inflection point, Qinmiao continued high growth. Non-epidemic situation led to a substantial decline in pig herds, reducing demand for basic vaccines in the future as breeding stock to rise, industry will follow the pick-up or scale. We believe that the 2020 swine vaccine market is expected to achieve more substantial recovery of growth, biotechnology shares, shares in animal husbandry head companies will significantly benefit. Qinmiao terms, of pork in 2020 due to the gap will continue to increase, we believe that poultry farming industry will continue to achieve volume and price, thus boosting the poultry vaccine market continued expansion.

Seeds: Variety competition still intense, waiting for the industry boom to pick up. In recent years, the amount of the state approved new varieties show explosive growth, industry homogeneous competition is not significantly improved. After corn supply side reforms of recent years, the level of inventory has returned to a reasonable level, prices have now warming trend, we expect 2020 corn acreage will rise slightly, corn seed market is expected to gradually pick up; stocks of rice and rice stocks are at a high level, the price of rice is still in shock bottoms stage, we believe that 2020 will further intensify competition in the rice seed market, rice seed business outlook or continue to face the industry during this painful, inventory backlog variety of market share continued to decline.

risk warning.?Agricultural prices have fallen sharply; African swine fever epidemic out of control; natural disasters.